Unequal Unemployment Effects of COVID-19 and Monetary Policy across U.S. States

One sentence summary: There is evidence for unequal unemployment effects of COVID-19 and the corresponding national monetary policy across U.S. states.

The corresponding working paper is available here.

Abstract

This paper shows that daily Google trends can be used as an alternative to conventional U.S. data (with alternative frequencies) on unemployment, interest rates, inflation and coronavirus disease 2019 (COVID-19). This information is used to investigate the effects of COVID-19 and the corresponding monetary policy on the U.S. unemployment, both nationally and across U.S. states, by using a structural vector autoregression model. Historical decomposition analyses show that the U.S. unemployment is mostly explained by COVID-19, whereas the contribution of monetary policy is almost none. An investigation based on the U.S. states further suggests that COVID-19 and the corresponding monetary policy conducted based on nationwide economic developments have resulted in unequal changes in state-level unemployment rates, suggesting evidence for distributive effects of national monetary policy.

Non-technical Summary

The weekly unemployment claims were about 281,000 in the week ending March 14th, 2020 according to the U.S. Department of Labor, reaching its highest level since September 2nd, 2017. In the corresponding news release, the U.S. Department of Labor announced the following statement:

"During the week ending March 14, the increase in initial claims are clearly attributable to impacts from the COVID-19 virus. A number of states specifically cited COVID-19 related layoffs, while many states reported increased layoffs in service related industries broadly and in the accommodation and food services industries specifically, as well as in the transportation and warehousing industry, whether COVID-19 was identified directly or not."where the Coronavirus Disease 2019 (COVID-19) was shown to be responsible. Even after five months, weekly unemployment claims were about 1,106,000 in the week ending August 15th, 2020 when the U.S. Department of Labor further announced the following statement:

"The COVID-19 virus continues to impact the number of initial claims and insured unemployment."where the continuous severity of COVID-19 effects on the U.S. unemployment can still be observed.

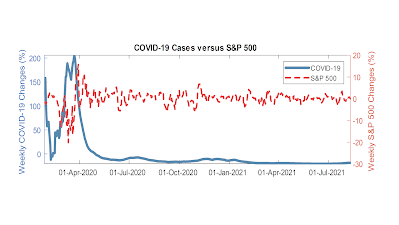

This paper investigates the dynamic relationship between COVID-19 and the U.S. unemployment by considering the effects of U.S. monetary policy, both nationally and across U.S. states. Since this investigation requires data on unemployment, interest rates, inflation and COVID-19, which are only available in alternative (e.g., daily, weekly, monthly) frequencies, this paper uses Google search queries capturing the desired variables on a daily basis. The sample covers the daily period between January 1st, 2020 and August 24th, 2020.

Before moving to the formal investigation, it is first shown that daily Google trends can be used as an alternative to conventional U.S. data (with alternative frequencies) on unemployment, interest rates, inflation and developments related to COVID-19.

The corresponding academic paper by Hakan Yilmazkuday has been accepted for publication at Journal of Behavioral Economics for Policy.

The corresponding working paper is available here.