COVID-19 Effects on the S&P 500 Index

One sentence summary: Having 1% of an increase in cumulative daily COVID-19 cases in the U.S. results in about 0.01% of a cumulative reduction in the S&P 500 Index after one day and about 0.03% of a reduction after one week.

The corresponding academic paper by Hakan Yilmazkuday has been accepted for publication at Applied Economics Letters.

The working paper version is available here.

Abstract

This paper investigates the effects of the coronavirus disease 2019 (COVID-19) cases in the U.S. on the S&P 500 Index using daily data covering the period between January 21st, 2020 and August 10th, 2021. The investigation is achieved by using a structural vector autoregression model, where a measure of the global economic activity and the spread between 10-year treasury constant maturity and the federal funds rate are also included. The empirical results suggest that having 1% of an increase in cumulative daily COVID-19 cases in the U.S. results in about 0.01% of a cumulative reduction in the S&P 500 Index after one day and about 0.03% of a reduction after one week. Historical decomposition of the S&P 500 Index further suggests that the negative effects of COVID-19 cases in the U.S. on the S&P 500 Index have been mostly observed during March 2020.

Abstract

This paper investigates the effects of the coronavirus disease 2019 (COVID-19) cases in the U.S. on the S&P 500 Index using daily data covering the period between January 21st, 2020 and August 10th, 2021. The investigation is achieved by using a structural vector autoregression model, where a measure of the global economic activity and the spread between 10-year treasury constant maturity and the federal funds rate are also included. The empirical results suggest that having 1% of an increase in cumulative daily COVID-19 cases in the U.S. results in about 0.01% of a cumulative reduction in the S&P 500 Index after one day and about 0.03% of a reduction after one week. Historical decomposition of the S&P 500 Index further suggests that the negative effects of COVID-19 cases in the U.S. on the S&P 500 Index have been mostly observed during March 2020.

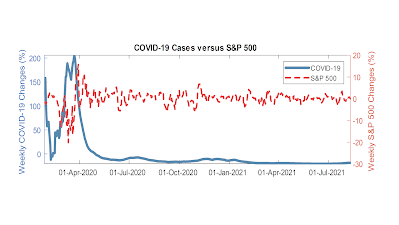

The coronavirus pandemic 2019 (COVID-19) has killed 618,363 people in the U.S. as of August 10th, 2021, with corresponding COVID-19 cases of 36,152,620. This has created a significant turmoil not only in the global economic activity but also in financial markets around the world. This turmoil can best be observed by the Standard & Poor's (S&P) 500 Index, which is the benchmark financial and economic indicator in the U.S. and fell from about 3,386.15 on February 19th, 2020 to about 2,237.40 on March 23rd, 2020, corresponding to about 41% of a fall, although it achieved a great recovery with record braking values such as 4,436.75 on August 10th, 2021.

This paper attempts to understand the reasons behind the volatility in the S&P 500 Index during COVID-19 by using daily data between January 21st, 2020 (when the first COVID-19 case was reported in the U.S.) and August 10th, 2021 (the latest day available when this paper was written). As this volatility in the S&P 500 Index may be due to COVID-19 or any other factor (e.g., the economic activity or interest rates), a formal analysis is required to identify the causal effects of COVID-19 on the S&P 500 Index. Such an investigation is achieved in this paper by using a structural vector autoregression (SVAR) model, where the S&P 500 Index is used together with a measure of the global economic activity and the spread between 10-year treasury constant maturity and the federal funds rate in the U.S. Since COVID-19 is an exogenous shock, percentage changes in cumulative daily COVID-19 cases in the U.S. are included as an exogenous variable in this framework.

Following several early or recent studies in the literature, the global economic activity is measured by the Baltic Exchange Dry Index (BDI). This is a daily published index by the Baltic Exchange in London, and it reflects the shipping costs (due to using vessels of various sizes covering multiple maritime routes) regarding the transportation of raw commodities (e.g., grain, coal, iron ore, copper). Since these shipping costs are determined by the supply and demand forces in the global market, they are robust to any speculative manipulation or any government intervention by construction. The spread between 10-year treasury constant maturity and the federal funds rate in the U.S. not only reflects the term premium (between long-run and short-run interest rates) but also the future expectations in the U.S. economy.

The empirical results suggest that having 1% of an increase in cumulative daily COVID-19 cases in the U.S. results in about 0.01% of a cumulative reduction in the S&P 500 Index after one day and about 0.03% of a reduction after one week.

Historical decomposition of the S&P 500 Index further suggests that

the negative effects of COVID-19 cases in the U.S. on the S&P 500

Index have been mostly observed during March 2020.

The corresponding academic paper by Hakan Yilmazkuday has been accepted for publication at Applied Economics Letters.

The working paper version is available here.